Introducing Rover: The New Frontier of Bitcoin Liquid Staking on the Spiderchain

Rediscover the Bitcoin Economy with Rover

Since 2009, Bitcoin has been the largest and most popular cryptocurrency asset. Today, Bitcoin functions primarily as a store of value asset, offering a hedge against constantly inflated fiat currencies. For most people, utilizing Bitcoin involves simply buying, holding and (optionally) eventually selling it. There is limited usage of Bitcoin as a means of payment, and because Bitcoin does not have a turing-complete transaction scripting language, developers cannot build advanced smart contracts on top of it natively.

The Bitcoin community rightfully doesn’t want there to be massive changes to the core Bitcoin protocol to accommodate DeFi. If Bitcoin followed the path of Ethereum with Bitcoin Improvement Proposals, otherwise known as BIPs or shiny new tokens being shoehorned into their blockchain, it could introduce new security vectors potentially diluting some of the purity that makes it the world’s premier store of value asset.

Bitcoiners value decentralization, security, and scarcity, above all else, and are okay with the limitations to speed and scalability that come with these core principles. If only there was a way to satisfy the traditional values of Bitcoiners, whilst simultaneously carefully and elegantly bringing DeFi composability…

What about DeFi on Bitcoin Layer 2? A Brief Primer

The lack of DeFi on Bitcoin has been an ever growing pain point since the launch of Ethereum and ‘DeFi Summer’ in 2020. Since then, the Total Value Locked (TVL) on Ethereum peaked at $120 billion in 2022, and is currently hovering around $50 billion. Several other blockchains have also emerged as DeFi hubs, all fulfilling different niches across the ecosystem. The total value locked in DeFi across chains is now $85 billion and is projected by some to grow upwards of 40% per year through 2030.

Sure, the dApps on Ethereum, Solana, and other emerging blockchains are impressive and useful, but what about tapping into the biggest liquidity source of them all? Bitcoin, despite being the largest cryptocurrency accounting for over 50% of the market cap of the entire industry, accounts for just under 5% of the TVL in DeFi. When looking at these stats, it becomes increasingly clear that there is a massive opportunity in unlocking the idle capital sitting in Bitcoin.

Early attempts at using Bitcoin in DeFi have yielded humble results. Usually, the first generation Bitcoin “layer 2”s fell into one of two camps. On one hand, many solutions were simply glorified (and centralized) bridges to Ethereum’s DeFi ecosystem. On the other hand, early native Bitcoin L2s proved cumbersome for developers to build upon and faced their own centralization challenges. While alternative solutions currently exist on the market and have made limited headway towards this objective, they often compromise core aspects of the Bitcoin ethos.

Today, a fresh wave of enthusiasm within the space has hit crypto markets, buoyed by the approval of spot Bitcoin ETF’s in January of this year. New advancements in cryptography and protocol design are being explored to overcome the Bitcoin⇔DeFi barrier with more sophisticated Layer 2 solutions.

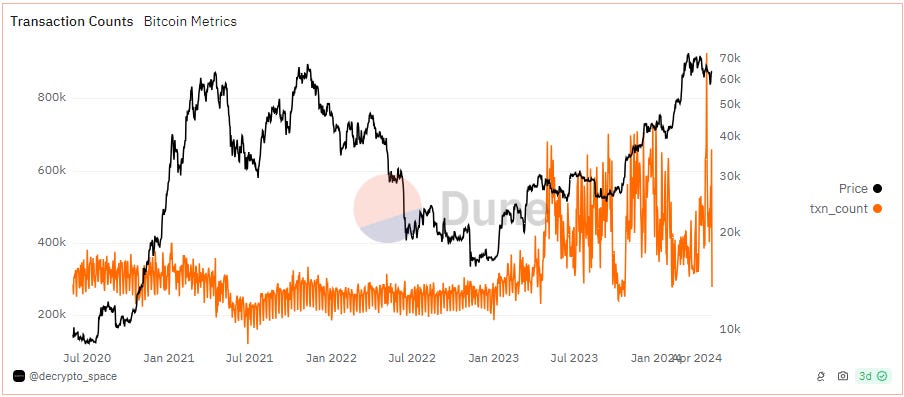

Though volatile, daily transaction volume on Bitcoin is clearly trending upwards. To date, Ordinals and BRC-20s represent most of this activity, and indicate that Bitcoiners are comfortable with and looking for new ways to use their Bitcoin on-chain. We believe this implies strong product-market fit for DeFi on Bitcoin.

Enter The Spiderchain

In early 2022, a group of Harvard MBAs and cryptography experts formed Botanix Labs, and came up with a pretty brilliant solution to this problem.

Enter: The Spiderchain, a layer-two blockchain that runs on Bitcoin at its core, preserving all the properties of bitcoin. Then, it layers on an EVM for plug and play DeFi composability, powered by the Spiderchain (sorry to all of you superhero fans, there is no relationship to Spiderman). The Spiderchain safeguard all funds moved up from the Bitcoin base layer through a web of decentralized multisigs held by randomized sets of orchestrators.

Unlike other solutions, the Spiderchain doesn’t require a BIP. And it doesn’t use any funny gas tokens either – the entire chain is powered, and accrues value, to Bitcoin.

That’s what separates the Spiderchain from the rest, and that is why we are so bullish on its future. It’s the first and only Bitcoin L2 that upholds the core principles of Bitcoin, while allowing for seamless access to DeFi.

Hello Rover

Rovers have the ability to capture images and gather data about the planet through temperature assessments, as well as collect rock and soil samples. Well, our Rover is a little bit different. The team at Rover is building liquid staking for Bitcoin holders on the Spiderchain.

So, what is Rover’s role in all of this? With DeFi comes deposits, and that’s where Rover comes into play. Rover enables Bitcoin holders to stake and participate in DeFi, all the while maintaining liquidity.

Getting Liquid with RovBTC

RovBTC will serve as the native Liquid Staking Token (LST) on the Spiderchain, which functions as the heart of DeFi on the network, representative of actual Bitcoin staked on the Spiderchain. Stake your Bitcoin and receive rovBTC. Simple enough, right? We anticipate rovBTC to emerge as a foundational element within DeFi, operating as a cornerstone for the Bitcoin money-lego stack.

With rovBTC, Bitcoiners will be able to put their capital to work, borrowing, farming, trading and more against their preferred unit of account, Bitcoin. We’ve put together a team with extensive experience in Web3, with prior backgrounds in TradFi, Consulting, Computer Science, Marketing and Operations to help make Rover a moving success.

Security Matters

Security does matter. We are working with the best auditors in the business to review our hard work. Audits to be announced and released soon!

Join the Rover Community

For now, welcome to the beginning of one of the most important developments in cryptocurrency (and Bitcoin) history. Join our socials below to keep up to date with the latest news!

lfg